To make sure you’re not adding more tasks to your to-do list like having to check up on it and manually post, you want to invest in a social media management tool. Let’s say you just started your business’s social media account. But what about the opposite? The answer is prepaid expenses, and they’re actually more common than you think. So accrued expenses are a payable account that is a liability on your balance sheet. At the end of the accounting period, you close out the accrued expense on your books with the following journal entry: Account You agree, she deposits the money into her account, and the rent expense has finally been paid. Mind sending me an e-transfer when you get a chance?” “Sorry,” she says, “I’ve been relaxing on the beach all week and completely forgot about this. Now let’s say the landlord gets in touch a week later. You now carry $3,000 in accrued expenses on your books to reflect the $3,000 you owe the landlord. So you make the following adjusting entry in your books: Account However, because you use the accrual basis of accounting, your books will still need to reflect the rent expense. It becomes clear that you won’t be able to pay the landlord for the first month of rent until she gets back in touch with you. March 1st rolls around, and there’s still no word from her. You look over the lease and realize it doesn’t actually specify how the landlord would like to get paid or where to send the money. She won’t pick up the phone or answer her email, and her answering machine says she’s in Cuba. In fact, you’re having trouble getting ahold of them.

So far, so good.įast forward to the end of the month (let’s say it’s February), and you still haven’t heard from the landlord about payment. You’ve signed a lease and agreed to pay the landlord $3,000 a month, picked up your keys, and started moving in your equipment.

Let’s say your business, a combination bookshop, record store, and taqueria, rents a brand new street-level retail space.

DEFINITION OF ACCRUED EXPENSES HOW TO

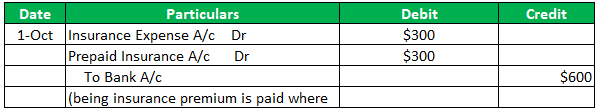

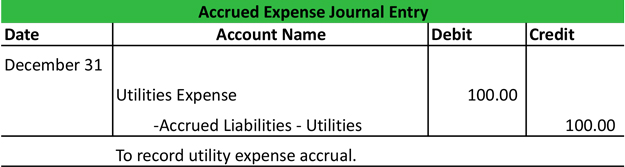

How to record adjusting journal entries for accrued expenses Talking to a CPA can help you choose the method that’s best for you. Your accounting method greatly affects your financial reports and how you understand the financial health of your business. Using the accrual method, you would record a loss of $2,000 for the reporting period ($2,000 in income minus $4,000 in accounts payable). Using the cash basis method, the profit for the reporting period would be $500 ($1,000 in income minus $500 in fees).

You only record accrued expenses in your books if you run your business under the accrual basis of accounting.

0 kommentar(er)

0 kommentar(er)